It is widely believed that biofuels can replace diesel and petrol on a large scale to meet today’s and future demand for road transport while reducing emissions. On balance, this is a simplistic and mistaken opinion. Let us see why.

Key points and recommendation:

- Whether first, second or later generations, the limited availability of raw materials for the production of biofuels allowing substantial contribution to reducing emissions in the transport sector, indicates the need to limit their use only where no real alternatives exist, such as aviation and long-distance shipping.

- The potential role of biofuels in the decarbonisation of transport is illustrated by the International Energy Agency (IEA) scenarios. In the net-zero scenario aligned to the 1.5°C target, the alternative to fossil fuels in road mobility are not biofuels. Instead, it is electric power, with electricity produced from renewable sources already available on a large scale and expected to grow strongly in the coming years. Market data on the transition to electric vehicles confirm the trajectory highlighted by the IEA’s net-zero

- Already today, 41% of the liquid biofuels released for consumption in Italy are produced from virgin and waste raw materials imported from Asia. Critical issues related to fraud on certification of origin, with products imported as waste mixed with cheap virgin oils and high ILUC impact have emerged.

- To feed the projected production of Italian biorefineries, large quantities of vegetable oil from Asia as well as virgin castor oil from Africa are expected to be imported. Castor oil is known an ideal crop for biodiesel production as it can grow even on degraded and arid soils. However, the intensive cultivation of castor required for biodiesel production is highly dependent on factors such as irrigation, mechanisation, fertilisation, pesticide use and the use of hybrid seeds, which reduce its sustainability as a feedstock.

- In addition to the critical issues related to the actual sustainability of these solutions, the doubt remains as to the real advantage for Italy’s strategic autonomy of a development model based on the prevalent supply of imported biomass.

- These aspects suggest a downsizing of the quantities of biofuels envisaged in the National Integrated Energy and Climate Plan (NECP), as well as a different distribution between transport modes, with a view to a prevalent use for the aviation and shipping sectors.

The value of biofuels globally

Transport accounts for 23% of total greenhouse gas emissions and 26% of final energy consumption, almost entirely from fossil fuels (96%). Biofuels now cover just 3.5% of the sector’s energy needs. Although the IPCC considers CO2 emissions from their combustion to be zero, the actual contribution is not really that and varies depending on the type of biomass used. Moreover, the exponential growth of the market in recent years has already brought to light many critical issues concerning the availability of raw materials for truly sustainable production and not in competition with the food supply chains[1].

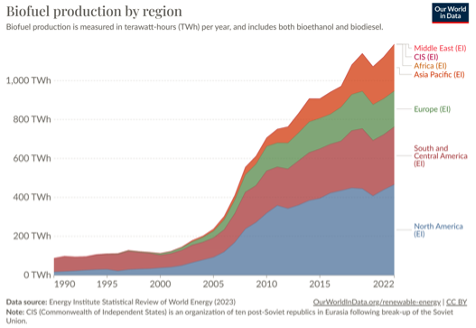

Fig. 1 – Development of biofuel production worldwide since 1990

Source: Our World in Data[2]

The prefix ‘bio’ in front of fuels, in fact, indicates production from renewable raw materials of biological origin (i.e. biomass), which is not necessarily and automatically synonymous with sustainable.

First generation’ biofuels

These are fuels derived from agriculturally derived biomasses such as sunflower, rapeseed, maize, palm, etc. While it is true that the plants cultivated for the production of the source biomasses, as they grow, absorb CO2 from the atmosphere (photosynthesis) in an amount substantially equivalent to that released through their combustion, it is equally true that significant amounts of water, fertilisers, pesticides and energy, mostly of fossil origin, are consumed to cultivate them.

Furthermore, biomass has to be transported and processed in energy-intensive industrial processes, using additives and reagents of fossil origin. Biodiesel, for instance, can be produced from vegetable oil in various ways: by adding methanol or ethanol (produced from methane or petroleum) to obtain a biodiesel called FAME (Fatty Acid Methyl Esther); or by using hydrogen (nowadays produced from methane, if not coal, then the most emissive type of all, called ‘grey hydrogen’) to obtain the so-called HVO (Hydrotreated Vegetable Oil) biodiesel.[3]

Industry studies show that over the cultivation-production-consumption lifecycle of first-generation biofuels, the actual emission reduction benefit is at most 60 per cent compared to that of a fossil-based equivalent, depending on the type of biofuel and the vegetable feedstock used.[4]

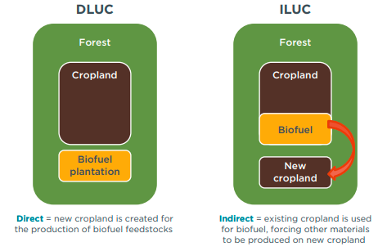

Industrial production aspects, however, are only part of the reduced emission reduction benefit associated with first-generation biofuels. Another major issue affecting real sustainability concerns the effect of land use change – which can be direct (Direct Land Use Change, DLUC) or indirect (Indirect Land Use Change, ILUC, see Fig. 2).

This is the direct or indirect transformation of virgin land, such as a forest or wetland, with a high permanent natural carbon storage capacity, into agricultural land for energy purposes, in which the carbon storage of cultivated biomass is much lower and is an end in itself, as it is eventually burnt, emitting the same amount of CO2 absorbed while growing.

Fig. 2 – Illustration of DLUC and ILUC land use change

Source: ICCT[5]

This problem emerged in a major way with the strong expansion of the biofuel business in the early years of the century (see Fig. 1), when in order to make room for plantations of vegetables to be used as energy raw materials, forests were cut down, especially in South America, Asia, Africa,[6] reducing the important contribution of these ecosystems to climate balance and biodiversity.[7]

Impact studies that take these effects into account, e.g. on the consumption of biodiesel derived from oilseeds such as rapeseed, soya and palm, show that CO2 emissions from the production and consumption of this biofuel may even be higher than from fossil diesel.[8]

Second-generation biofuels?

From a climate perspective, first-generation solutions must be replaced by production chains of successive generations of sustainable biofuels. Available today on an industrial scale are ‘second-generation’, or advanced, biofuels obtained from the processing of residues and waste, if not from particular types of non-food biomasses resistant to drought climates and cultivated on degraded land not in competition with food supply chains.

Bioethanol, biodiesel and biomethane can also be produced from cellulosic forestry residues, the organic fraction of municipal solid waste, residues from food processing chains, animal farm waste, used cooking oil, etc. In these cases, the contribution to the reduction of climate-changing emissions compared to fossil equivalents is estimated to be higher than in the first generation, although a non-zero share of emissions remains due to transport and industrial processing for production.

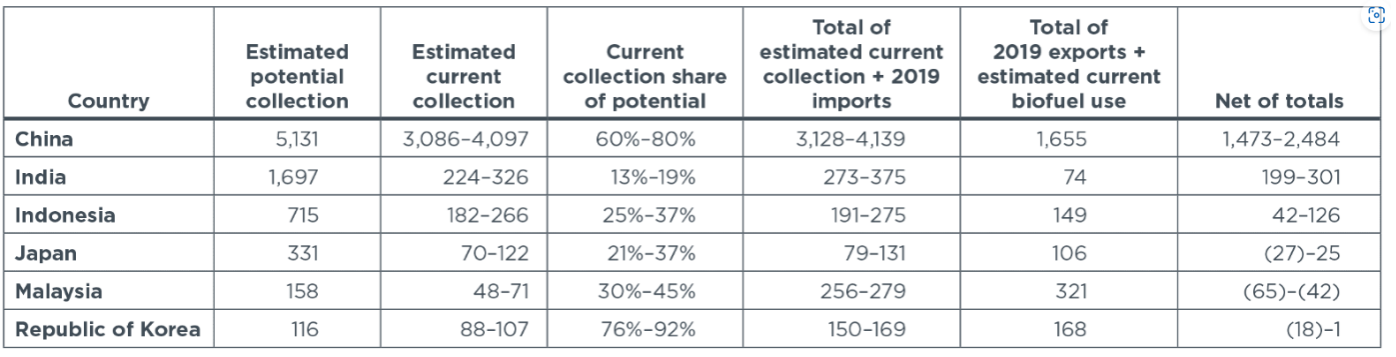

Advanced biodiesel derived from used cooking oil (UCO) is among the most emission-reducing solutions compared to a fossil equivalent.[9] China, India and Indonesia are among the largest global producers of UCO, the availability of which, however, remains very limited (see Fig. 3).[10]

This and the strong push of policies to support demand for UCO in markets such as the EU and the US, with imports expected to double by 2030, point to an upward shift in price dynamics with the consequent risk of biodiesel production becoming increasingly dependent on government subsidies.[11]

Fig. 3 – Estimated UCO potential and utilisation for biofuel production in Asia

(values in thousand tonnes/year)

Source: ICCT13

Moreover, for waste, critical issues remain related to fraud on certification of origin, with products imported as waste mixed with cheap virgin oils and high ILUC impact.[12]

Whether first-, second- or later-generation, the limited availability of raw materials for the production of biofuels capable of making a substantial contribution to the reduction of greenhouse gas emissions, particularly in the transport sector, indicates the need to limit their use to those modes for which there is no real alternative.

This is the indication that emerges from all the most accredited decarbonisation scenarios, which also confirm projected growth in demand for biofuels in the coming years.

Role of biofuels in the decarbonisation pathways of the transport sector

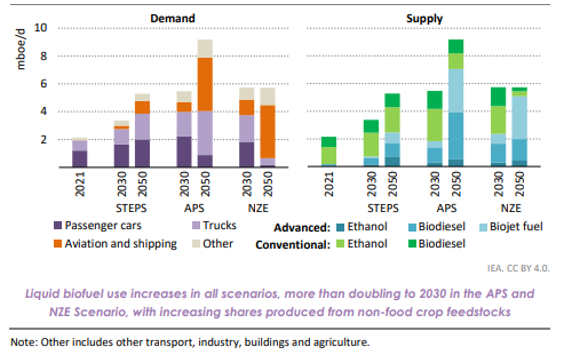

The potential role of biofuels in the decarbonisation of transport is illustrated in the International Energy Agency (IEA) scenarios.[13] For biofuels, the substantial difference between the three assumed scenario forecasts (current policies or STEPS; announced commitments or APS; net-zero aligned to 1.5°C or NZE)[14] lies in the final quantities consumed and for which sectors they are used.

Fig. 4 – Supply and demand for liquid biofuels according to the IEA

Source: IEA

By 2030, the NZE scenario predicts three times more biofuel consumption than in 2021, or 10% of total transport energy consumption. Consumption will be absorbed by road transport, with a small share for aviation and shipping. Looking ahead to 2050, things change dramatically. The lack of ambition of the commitments announced by governments for the electrification of road transport (APS scenario) would lead to a 50% growth in total biofuel consumption vs. 2030, entirely absorbed by this sector. In contrast, the forecast of biofuel consumption in the NZE scenario to 2050 remains almost identical to that of 2030 and is completely absorbed by the aviation and maritime sectors.[15]

In other words, in a scenario compatible with the ambitions of net-zero emissions by 2050, the alternative to fossil fuels in road mobility is electric vehicles with electricity produced from renewable sources, already available on a large scale and expected to grow strongly in the coming years.[16] All this within a framework of an overall reduction in the demand for final energy, thanks to a rationalisation and reduction of the demand for private mobility, as well as the greater energy efficiency of electric vehicles, which is already more than three times higher than that of traditional endothermic vehicles.[17]

Market data on the transition to electric vehicles confirm the trajectory highlighted by the IEA’s NZE scenario. By 2022, electric vehicles have reached a 10 per cent global share of sales.[18] Bloomberg’s economic scenario estimates show exponential growth in the coming years, indicating that as early as 2040 half of all vehicles on the road will be electric and mainly BEVs.[19]

The strategy to follow is, therefore, to concentrate the use of biofuels where there are no electric alternatives, such as aviation and long-distance shipping, as also emerged from a recent study by the Transport Committee of the European Parliament.[20]

What strategy for Italy on biofuels?

In 2021, the consumption of liquid biofuels on the road in Italy was about 1.6 million tonnes, 98% as biodiesel. Overall, 493 thousand tonnes of biodiesel were produced domestically (31% of the total), but only 92 thousand tonnes with local raw materials (6% of the total). 41% of the liquid biofuels released for consumption in Italy are produced with virgin and waste raw materials from China and Indonesia.[21]

The Government’s proposed revision of the National Energy and Climate Plan (NECP) in 2023 envisages doubling the consumption of liquid biofuels, mainly biodiesel, for road transport to around 3 million tonnes.[22]

For domestic biodiesel production, the main reference are Eni’s Porto Marghera and Gela plants, already converted to biorefineries, and, in perspective, Livorno,[23] with a forecast installed production capacity of over 1.7 million tonnes by 2025.[24]

For the supply of the plants, large quantities of waste vegetable oil are expected to be imported from Asia, as well as virgin oils from agricultural raw materials thanks to the development of African agri-feedstocks in Kenya and Congo – and in the foreseeable future in Angola, Côte d’Ivoire, Mozambique, and Rwanda – with a prospect of producing more than 700,000 tonnes of vegetable oil derived from castor beans already by 2026.[25]

Numerous scientific publications confirm that castor oil is an ideal crop for biodiesel production as it is suitable for growing even on degraded and arid soils, stressing, however, that the productivity of castor oil crops for intensive industrial uses, such as those intended for biofuels, are highly dependent on factors such as irrigation, mechanisation, fertilisation, use of pesticides, and use of hybrid seeds,[26] which contribute to reducing the sustainability of these crops. Furthermore, the repercussions of monoculture farming practices on ecosystem services and their potential impact on the food security of local populations should also not be ignored.[27]

In addition to the critical issues related to the actual sustainability of these solutions, the doubt remains as to the actual advantage for the country’s strategic autonomy of a development model based on the prevalent supply of imported biomass.

These aspects suggest a downsizing of the quantities of biofuels envisaged by the NECP, as well as a different distribution between transport modes with a view to a predominant use for the aviation and shipping sectors.

This would be possible by envisaging a rationalisation and structural reduction of road transport consumption, flanking the electrification of vehicles with alternative mobility solutions to the car, through effective policies to promote and support the demand for sustainable mobility.

NOTES

[1] Thought for food – A review of the interaction between biofuel consumption and food markets (cerulogy.com); The Global Food-Energy-Water Nexus – D’Odorico – 2018 – Reviews of Geophysics – Wiley Online Library; How to Sustainably Feed 10 Billion People by 2050, in 21 Charts | World Resources Institute (wri.org)

[2] Biofuel production by region (ourworldindata.org) (Statistical Review of World Energy (energyinst.org))

[3] Comparison of Biofuel Life Cycle Analysis Tools: FAME and HVO/HEFA | Bioenergy

[4] Environmental sustainability of biofuels: a review | Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences (royalsocietypublishing.org)

[5] Understanding options for ILUC mitigation – International Council on Clean Transportation (theicct.org)

[6] A global analysis of deforestation due to biofuel development | Omar Masera – Academia.edu; Biofuels Development and Indirect Deforestation | SpringerLink

[7] Implications of Biodiesel-Induced Land-Use Changes for CO2 Emissions: Case Studies in Tropical America, Africa, and Southeast Asia. Ecology and Society (researchgate.net);

[8] 2016_04_TE_Globiom_paper_FINAL_0.pdf (transportenvironment.org)

[9] Used-cooking-oil biodiesel: Life cycle assessment and comparison with first- and third-generation biofuel – ScienceDirect

[10] An estimate of current collection and potential collection of used cooking oil from major Asian exporting countries – International Council on Clean Transportation (theicct.org); UCO supply reaching its limits | Biofuels International Magazine (biofuels-news.com)

[11] Global UCO supply to double by 2030 as US, EU policies drive Asian supply (spglobal.com)

[12] The OLAF report 2019 – Publications Office of the EU; ISCC ‘deficient’ in combating EU biofuel fraud: investigative report (qcintel.com); Brussels must tackle biofuels fraud to keep long-term climate ambitions on track (european-views.com)

[13] World Energy Outlook 2022 – Analysis – IEA

[14] Understanding GEC Model scenarios – Global Energy and Climate Model – Analysis – IEA

[15] The data and graph refer to the IEA World Energy Outlook 2022 forecast or scenario. In the World Energy Outlook 2023, the agency revises downwards the total consumption forecasts of the APS scenario (ca. 6.9 mboe/year), while those of the NZE scenario are substantially confirmed.

[16] Renewable electricity – Renewables 2022 – Analysis – IEA

[17] JRC Publications Repository – JEC Tank-to-Wheel report v5: Passenger cars (europa.eu)

[18] EV-Volumes – The Electric Vehicle World Sales Database

[19] EVO Report 2023 | Bloomberg NEF | Bloomberg Finance LP (bnef.com)

[20] Research for TRAN Committee: Assessment of the potential of sustainable fuels in transport (europa.eu)

[21]Energy in the Transport Sector 2005-2021.pdf (gse.it)

[22] Italy – Draft Updated NECP 2021-2030 (europa.eu)

[23] To support the upgrading of existing biorefineries or the conversion of oil refineries into new biorefineries in Italy (such as the plants in Stagno, in the province of Livorno), it was initially planned to use funds from the RepowerEU Plan. In the project review process, the European Commission did not allow this type of project to be financed with EU funds.

[24] 2023 Capital Markets Update & 2022 Full Year Results (eni.com). The company’s plan envisages a global installed production capacity of over 5 million tonnes of biorefining products by 2030 (see Eni’s Evolution: The Long-Term Strategic Plan to 2050).

[25] Agri-feedstock projects in Kenya and Congo | Eni

[26] A Review on the Challenges for Increased Production of Castor | Agronomy Journal (wiley.com); Strategies for improving the value chain of Castor as an industrial raw material in Nigeria (researchgate.net); Seed yield and yield components of castor influenced by irrigation – ScienceDirect

[27] Impacts of biofuel crop production in southern Africa: Land use change, ecosystem services, poverty alleviation and food security | SEI; How to Sustainably Feed 10 Billion People by 2050, in 21 Charts | World Resources Institute (wri.org)

Photo by Gustavo Fring