On 23 July 2025, Rome hosted the Fifth Italy–Algeria Intergovernmental Summit, co-chaired by Italian Prime Minister Giorgia Meloni and Algerian President Abdelmadjid Tebboune. Aimed at strengthening bilateral ties, the meeting was held alongside the Italy–Algeria Business Forum, organised by the Ministry of Foreign Affairs and International Cooperation and the Italian Trade Agency. The two delegations signed over 40 bilateral cooperation agreements, reaffirming the exceptional nature of the strategic partnership between Rome and Algiers.

Energy featured prominently on the summit’s agenda, underscored by the participation of ENI CEO Claudio Descalzi and Sonatrach CEO Rachid Hachichi.

While energy has long played a key role in Italy–Algeria relations, the agreements reached at this summit also highlight critical issues in the two countries’ energy transitions. Despite clear signals of intent to move away from gas dependence and towards a fair, future-proof transition (renewables, electricity grids), gas remains a central component, one that is likely to remain so for decades to come. Italy’s engagement with Algeria, and more broadly with North African countries, in the field of the energy transition should instead prioritise improving technical support for local energy actors and promoting capacity-building programmes. These would lay the foundations for long-term economic development and deeper, cleaner industrial and economic cooperation.

The energy dimension in Italy–Algeria relations

The energy sector remains at the heart of relations between Italy and Algeria, even though, over the years, trade relations have gradually evolved into a broader economic partnership.

Despite periods of political instability in Algeria, including the internal conflict of the 1990s, Italy has consistently maintained strong ties with Algiers. These were further strengthened in the early 2000s with the signing of the Treaty of Friendship, Cooperation and Good Neighbourliness. Following the treaty, a long list of subsequent agreements was concluded in key areas of bilateral interest (particularly energy, trade, security, migration and culture) accompanied by a significant presence of Italian companies operating on Algerian soil.

In 2022, in response to the European energy crisis following Russia’s invasion of Ukraine, the relationship entered a new phase. Algeria committed to significantly increasing gas supplies to Italy, positioning itself as a strategic alternative to Russia in the Italian energy market. By 2024, trade between Algeria and Italy had reached a total value of $15.9 billion. Exports of gas and refined oil amounted to $10.7 billion, down 23.5% year-on-year due to falling gas prices, but Algeria still recorded a trade surplus of 8.6 billion dollars with Italy.

Algeria is currently Italy’s main supplier of gas, accounting for around 36% of total Italian gas imports via pipeline. Italy, in turn, is the largest export market for Algerian gas delivered through pipelines, with a share exceeding 40%.

Agreements reached at the Italy–Algeria Summit

The energy agreements concluded at the July 2025 Summit build upon a series of earlier bilateral accords.

Summary of agreements reached between Italy and Algeria in recent years:

|

Date and occasion |

Key energy agreements |

|

| Apr 2022 – Draghi’s visit to Algiers (pre-4th Summit) ) |

|

|

| July 2022 – 4th Summit in Algiers (Draghi–Tebboune |

|

|

| Jan 2023 – Meloni at Algiers (Bilateral visit) |

|

|

| July 2025 – Summit in Rome (Meloni–Tebboune) |

|

|

The cooperation between Italy and Algeria has evolved into a long-term strategic relationship. The agreements signed in 2025 do not replace previous ones; rather, they build upon and expand them.

Italy and Algeria: challenges for the energy transition

The agreements signed in Rome in July 2025, covering renewables, electricity infrastructure and local development, reflect a shared intention to move away from fossil fuels and towards a just energy transition. They position Italy as a key partner in North Africa and as a hub for renewable energy. However, at the same time, the agreements to increase gas supplies carry potential risks for both countries.

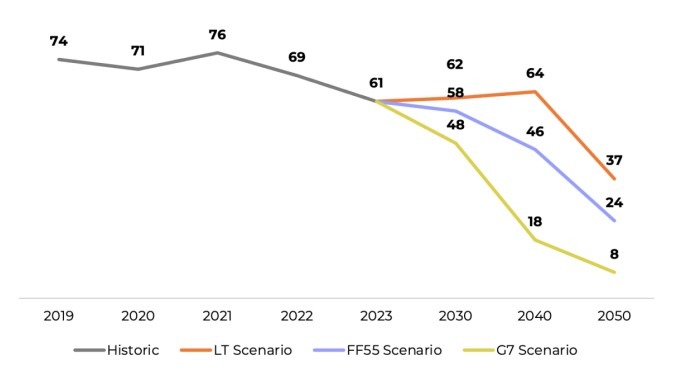

For Italy, increasing imports from the south would require a significant upgrade of the domestic transport network, pushing the country toward the so-called “Late Transition” scenario already described by ECCO. This trajectory would distance Italy from the targets set out in the EU’s Fit-for-55 package and from the decarbonisation commitments it has made within the G7 framework.

Italian demand for gas in 2019, 2020, 2021, 2022 and 2023, and scenarios for evolution in 2030, 2040 and 2050 [bcm/year]. Source: MASE, Snam and processing by ECCO

Our recent analysis shows that long-term commitments to fossil fuel supply significantly increase the risk of a gas lock-in for both countries. Agreements totalling around 20 billion cubic metres per year — in addition to recently signed 20-year contracts with the United States and the $750 billion in new US LNG purchases promised by Ursula von der Leyen under the recent trade agreement with Donald Trump — are not compatible even with the most optimistic scenarios.

Italy’s increased export capacity effectively puts it in direct competition with the export capacity of several Northern and Eastern European countries (the Baltics, Germany, the Netherlands, Belgium, Poland, Greece and Bulgaria), which have also invested in new LNG terminals in response to the collapse of Russian gas flows to the continent. As a result, Italy risks creating an oversized gas system, with underutilised volumes as early as 2040 under intermediate demand scenarios. This raises the risk of stranded assets — infrastructure that fails to recoup its original investment — leading to higher energy bills for households and businesses alike.

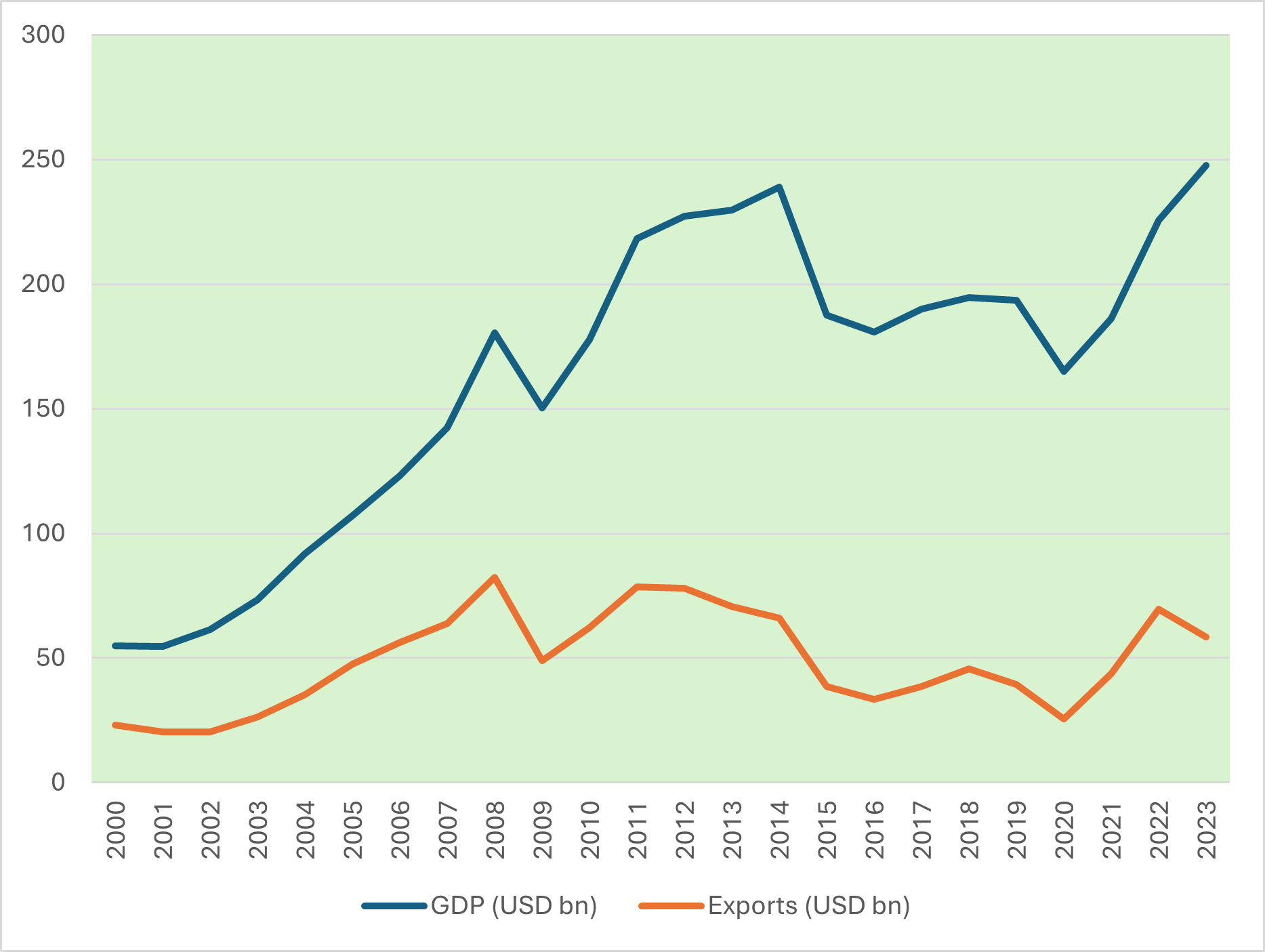

Finally, for Algeria, a country whose economy heavily depends on hydrocarbon exports, the continued focus on gas could delay a much-needed path of economic diversification, making the country more vulnerable to the international context. The figure below illustrates the strong correlation between Algeria’s GDP and its exports.

Source: adapted from World Bank Development indicators, UNCTAD stat

In a context where Italy and Europe are pursuing their decarbonisation goals, and where geopolitical factors can rapidly alter regional and global balances, Algeria risks being vulnerable to a decline in gas revenues, on which the country is heavily reliant.

Italy’s role in the Mediterranean

Italy is well placed to play an active and systemic role in promoting the energy transition across Mediterranean countries. In this context, cooperation between Italy and Algeria should go far beyond the energy sector, extending to local development and industrial cooperation on transition technologies.

Italy’s engagement with its North African partners should be guided by a synergistic approach. Diplomacy, politics and industry must work side by side to promote shared national and international priorities. Within this framework, the active and coordinated involvement of (and with) the Italian private sector is a key factor, helping to translate political vision into tangible results and serving as a backbone for implementation. Italy has both the means and the tools to establish itself as a Mediterranean leader within the EU at a time of political opportunity, marked by the revision of EU relations with its southern neighbourhood through the development of a New Pact for the Mediterranean.

Finally, Italy’s engagement with Algeria, and by extension with North African countries, in the energy transition should prioritise improving technical assistance to local energy actors and promoting capacity-building programmes as a foundation for clean economic and industrial cooperation. By providing targeted expertise in renewable energy technologies, grid modernisation and sustainable resource management, Italy can make a meaningful contribution to the development of local infrastructure. Collaborative, co-developed projects, such as cross-border renewable energy hubs or joint research initiatives, could strengthen bilateral cooperation, ensuring a cohesive and efficient transition. This approach would not only support Algeria’s decarbonisation goals but also reinforce Italy’s role as a key partner and renewable energy hub in the Mediterranean’s future.

For further insight into the implications of a slow transition for Algeria and the Mediterranean, we are pleased to present a contribution from Jessica Obeid, Founding Partner of New Energy Consult and energy expert for the MENA region.

Read it here

Photo by Governo.it