Russia’s invasion of Ukraine – launched on 24 February 2022 – has caused significant repercussions on global energy markets, increasing the importance of policies for strategic energy autonomy. Price volatility, supply difficulties, and economic uncertainty have contributed to “the first truly global energy crisis, with impacts that will be felt for years to come,” as defined by the International Energy Agency (IEA). Above all, the crisis has called into question the energy partnership between Russia and Europe, which for more than 30 years had been based on the stable supply of gas at competitive prices.

Between May and October 2022, Russia reduced gas supplies to Europe by 80 percent. This has led Brussels to seek alternative partners and, especially, to give new impetus to the energy transition, which Commission President Ursula Von der Leyen defined as “functional to independence” in her 2022 State of the Union Address. Indeed, the energy crisis originated from Russia’s invasion of Ukraine has highlighted – both in Europe and in importing developing countries – the negative aspects of the reliance on fossil fuel sources, such as price volatility and excessive dependence on producing and exporting countries. In Europe, the mild winter and a reduced demand mainly due to rising prices have caused gas stocks to remain relatively stable during the coldest months of the year.

Although this has helped mitigate the impact of supply disruptions from Russia, the outlook for next winter may not be as good. According to the International Energy Agency (IEA), the EU may face a shortage of nearly 30 billion cubic metres of natural gas in 2023. As the Agency stated, this gap can be significantly reduced through greater efforts to improve energy efficiency, develop renewable energy, install heat pumps, and promote energy conservation. The search for alternative gas supplies can also be a complementary measure, but only when these efforts are not enough to narrow the gap.

The several documents with which Member States jointly responded to the crisis are very eloquent of the EU’s will to accelerate the energy transition with a view to reducing its dependence on Russia.

In March 2022, in the aftermath of the Russian invasion, European leaders meeting in Versailles stated their intention to reduce dependence on gas, oil, and coal imports from Russia. This is to be achieved through diversification of supplies, acceleration in the development of renewable energy sources, improvement of energy efficiency and reduction of consumption, and reduction of dependence on all fossil sources – not only those imported from Russia. The EU’s climate goals to 2050 will be central to all these steps. The will expressed in Versailles was implemented in the REPowerEU plan, proposed by the European Commission in May 2022 with a view to ending the bloc’s dependence on Russian fossil fuels by 2027.

Among other goals, the plan aims to increase the share of renewables in final energy consumption to 45 percent by 2030, exceeding the 40 percent target previously set in the first phases of negotiation. This new paradigm sees the transition as necessary for the EU’s energy security. Besides, it has influenced the negotiations on the various measures of the Fit for 55 package – which were initiated before Russia’s invasion of Ukraine – in order to turn the goals of the European Green Deal into concrete policies, increasing the ambitiousness of the plan after March 2022.

The acceleration of the energy transition has shown that a greater strategic autonomy stems from a decrease in the reliance on fossil fuel imports. But most importantly, the acceleration has led the EU to question its ability to meet the ambitious targets of the Fit for 55 without creating new excessive dependence and losing competitiveness with other economic blocs.

In particular, two issues have emerged as priorities. Firstly, the dependence on China for the supply of critical materials and components of strategic technologies for the energy transition and national security. Then, the competition with the US after that it enacted a massive incentive plan – the Inflation Reduction Act – for the reshoring of value chains for green technologies. The latter, in particular, has given further impetus to the debate in Europe about the need for Europe to have a new industrial policy for the development of transition technologies.

The United States and the Inflation Reduction Act

With the Inflation Reduction Act of 16 August 2022, the United States allocates $500 billion in spending and tax incentives in three packages: a tax reform, a health care reform, and an energy and climate reform. With nearly $400 billion allocated, the latter is the most significant of these packages. Through subsidies and tax relief, the IRA aims to reduce the gap between current US emissions and the 2030 target by two-thirds. Then, the IRA could generate indirect effects through lowering the cost of developing new technologies, allowing the remaining gap to be closed. Even though experts believe that the Act is less effective than tax inventive policies and the creation of a carbon market when it comes to emissions reduction, the IRA still represents an important step forward for US climate policy and how this impacts global emissions reduction.

Most of the $394 billion in energy and climate funding is in the form of tax credits aimed at catalysing private investment in the production of clean energy technologies. Businesses are the main beneficiaries, with an estimated $216 billion worth of tax credits. Then there are incentives for consumers, who are granted tax credits worth $43 billion, thus making electric vehicles, energy efficient appliances, installation of solar panels, geothermal heating, and home batteries more affordable. However, these incentives are subject to certain conditions: many IRA tax incentives also contain local production and procurement requirements. For example, to unlock the full consumer credit for electric vehicles, a much of the critical minerals in the battery must be recycled in North America or mined or processed in a country that has a free trade agreement with the United States. In addition, the battery must be manufactured or assembled in North America.

The IRA thus contains protectionist elements: subsidies that are contingent on local content requirements – prohibited by World Trade Organization (WTO) rules – and subsidies to large-scale manufacturing that could lead to market and trade distortions. These elements have exacerbated EU fears that European clean-tech manufacturers will shift their production to the United States, seeking an attractive combination of subsidies and low energy costs. The divergence of views between Washington and Brussels does not particularly concern the volume of green subsidies, but rather their type.

Indeed, while IRA and EU subsidies for electric vehicle purchases and clean technology production are similar in size, renewable energy subsidies should still be much higher in the EU – based on the assumption that EU subsidy rates will be the same as the last few years. Besides, IRA subsidies discriminate against foreign producers in a different way from European ones. Another relevant aspect that shows the difference between the IRA and the EU’s policy approach concerns the way in which subsidies are disbursed. In the IRA, these are cumulative, easily bankable, and cover a 10-year period. EU support, instead, is more fragmented and generally considered to be slower, subject to complex bureaucratic procedures, and sometimes shorter in duration. Finally, in the clean technology sector, the IRA focuses mainly on the mass deployment of current generation technologies, while EU-level support largely extends to innovation and the early stages of new technology.

It is easier to understand the protectionist elements of the IRA if we take a look at the context in which it was passed. The US was undergoing a growing systemic competition with China and a political polarisation, which led the Congress to strongly revise the bill before passing it. These elements are cause for concern about the resilience of the global free trade system as well as the role of the United States therein. The use of subsidies in the IRA – both those permitted and those non-compliant with WTO rules – is clearly in contrast with the multilateral trade rules that the United States helped create. This is nothing new: the Trump administration had already taken this path by adopting tariffs on aluminium and steel imports from China.

However, the fact that the Biden administration is in line with these policies is suggests a profound trend in US policy, which is also a cause for concern for Europe. Moreover, the risk that others might react by emulating this unprecedented combination of subsidies that are non-compliant with WTO standards and rules on locally sourced content is detrimental to the global free trade system. French President Emmanuel Macron has already called for a ‘Buy European Act’ along these lines. All this is happening while the WTO – whose mission is supposed to be the enforcement of free trade rules – is in a moment of profound weakness, as it is still paralyzed by the US veto on the appointment of the Appellate Body’s judges.

The EU’s response: the Green Deal Industrial Plan and the need for strategic autonomy

Recently, the need for a sovereign industrial policy has been frequently debated in Europe. This debate was fuelled by the fear that the efficacy of US subsidies could lead to a decrease in the competitiveness of the European industrial fabric – already strained by the energy crisis that stemmed from Russia’s invasion of Ukraine. This is a difficult change of approach for the EU. The protection of the single market – the heart of the European project – is seen as incompatible with national industrial policies, as these create unequal conditions between companies that are located in different Member States. The maintenance of free competition and the vigilance against state aid have long been – and still are – cornerstones of the Commission’s work.

However, the unprecedented level of challenges – notably the launch of the IRA – is prompting the EU to reconsider the need to strengthen its industrial base. In a speech to the College of Europe in December 2022, Commission President Ursula Von der Leyen emphasised Europe’s commitment to seek an appropriate and well-calibrated response to the IRA, though without triggering a trade war with the United States. The method outlined by Von der Leyen consist of three elements: simplification and adaptation of state aid rules; creation of a Sovereignty Fund, that is to say, common European funds for a common European industrial policy (an idea that was already advanced in her State of the Union address in September 2022); and cooperation with the US in creating standards and establishing a critical raw materials club. Following up on what was outlined in Bruges, the Commission then proposed in February the Green Deal Industrial Plan, a plan for the industrial development of key technologies and skills for decarbonisation at a European level.

The plan has four pillars: simplification of the regulatory framework, unfreezing of financing in the short and medium term, skills development for workers, free trade agreements and other forms of cooperation with partners to advance the transition. To complement the first pillar, the Commission then presented in March the regulation proposals for the Net Zero Industry Act (NZIA) and Critical Raw Materials Act (CRMA). The NZIA defines the regulatory framework for the strategic technologies for the transition, for which a 40 percent production target is introduced on EU territory, and speeds up plant installation permission procedures, including environmental permits. The CRMA, on the other hand, aims to reduce dependence on foreign supply chains of critical materials. It also sets minimum targets for the demand for critical materials that are needed by EU industry by 2030 for the extraction (10%), refining (40%), and recycling (15%) within the Union. To differentiate the supply of critical materials, the EU intends to create strategic partnerships with third-party countries. The goal is to integrate mineral and industrial value chains between the EU and partner countries and to create cooperation on strategic projects.

The EU has already signed similar partnerships with Canada, Ukraine, Namibia, and Kazakhstan; others are currently being negotiated, especially in Africa. Through the Global Gateway plan, Brussels intends to support development projects on infrastructure, connectivity, and critical materials in these countries, with an emphasis on sustainability and value creation on the spot.

As for the second pillar of the Green Deal Industrial Plan – the unfreezing of financing – the Commission adopted last March the Temporary Crisis and Transition Framework, to revise state aid rules also in support of transition technologies. At the same time, a proposal for a European Sovereignty Fund is expected to be presented in June as a structural response to the new transition investment needs.

What kind of strategic autonomy?

Just over a year after the Russian invasion of Ukraine was launched, the EU has reduced its dependence on gas imports from Russia. Europe succeeded in ending the winter season with storage fill-ups of more than 50 percent (the year prior to the crisis, it was 20%) thanks to a combination of mild weather, increased LNG imports, slowing Chinese imports, and a drop in demand, which was caused, among other things, by high prices. Even though this is to be regarded as a success, we should not forget that Europe and its citizens have been strongly impacted by this crisis: the wholesale price of gas rose to record levels during the storage filling season – peaking at more than 335 euros per megawatt-hour last August – having disastrous effects on household bills, business energy costs, and European industrial competitiveness.

In addition, the diversification of supplies originated from the need to replace gas imported from Russia has drastically strengthened the bargaining power of alternative suppliers. A perceived position of weakness and emergency led Europe to lose the bargaining power in its dialogues with those partners with different values and interests.

Since Italy has shifted from being dependent on Russian to Algerian gas, our country might incur limited autonomy in certain foreign policy choices, should these be contrary to those of the Algerian regime (for example regarding the dispute with Morocco over the sovereignty of the Western Sahara region). This would also lead to the maintenance of a highly autocratic, rent-based power system. The same is happening at a European level: the strengthening of the partnership with Azerbaijan risks undermining the EU’s mediation role in the Nagorno-Karabakh conflict; that of the relationship with Israel deprives the EU of leverage for the mediation between Israel and Palestine.

Thus, the link between strengthening the EU’s strategic autonomy and accelerating the energy transition seems clear. Reducing the percentage of natural gas in the EU’s energy mix can rebalance the Union’s geopolitical weight in its relations with supplier countries. At the same time, this measure could act as a shield against future price fluctuations. Moreover, the gradual reduction of gas purchases, together with investments in renewable energy, would allow the EU to facilitate a just and efficient transition in its neighbouring countries, thus protecting against future instability that may stem from the demise of the oil&gas industry.

At the same time, though, accelerating the transition risks leaving the EU exposed to an overly unbalanced relationship with China. The Asian country has a quasi-monopoly on many technologies needed for the energy transition as well as on the refining of rare earth elements and other critical materials needed for their production. In this respect, the Green Deal Industrial Plan, the Critical Raw Materials Act, and other existing initiatives – such as the European Battery Alliance for building a European battery industry – are a good starting point.

Although it will be difficult for the EU to become totally independent from China, such initiatives can rebalance its role and ensure the competitiveness of European companies in future markets. Through the creation of partnerships – in particular with neighbouring as well as Sub-Saharan African countries – for the cooperation in building value chains for transition technologies, the EU will be able to recreate virtuous interdependence, safeguarding its ambition to be a climate leader as well as guarantor of the multilateral system based on free trade.

By supporting the creation of skills as well as jobs in green industries both internally and in neighbouring and Africa countries, the EU could make a real contribution to the creation of added value on the ground, the diversification of economies, and the creation of new opportunities for the large young population of the whole Mediterranean region and the African continent. For this to happen, it is necessary that the EU will not be tempted by protectionism, continuing instead to aim at an open strategic autonomy.

The increased autonomy would also contribute to creating a stronger EU, even in respect of the relationship with China. In this way, the Union can seek and hopefully achieve cooperation with Beijing on major global issues, starting from fighting climate change and redefining China’s role in the global framework of development aid and climate finance.

The Russian invasion of Ukraine and, before that, the Covid-19 pandemic have led the EU to face multiple unprecedented crises. In the background, an increasingly heated strategic rivalry between the United States and China has been threatening to further shatter what is left of the liberal global order centred on multilateralism. Furthermore, the climate crisis threatens human security and socio-economic stability in the EU as well as in the neighbouring countries and globally. In seeking greater autonomy and safeguarding its future competitiveness, the EU must prioritise multilateralism and investments in new value chains: cooperation with partners is crucial to create new bonds of virtuous interdependence, build greater independence from other countries – whether ‘old’ dependencies such as oil&gas or ‘new’ ones such as transition technologies – and build resilience to protect its citizens from the climate crisis. For these reasons, the response to the energy crisis can only be the acceleration of the transition; strategic autonomy must be none but open.

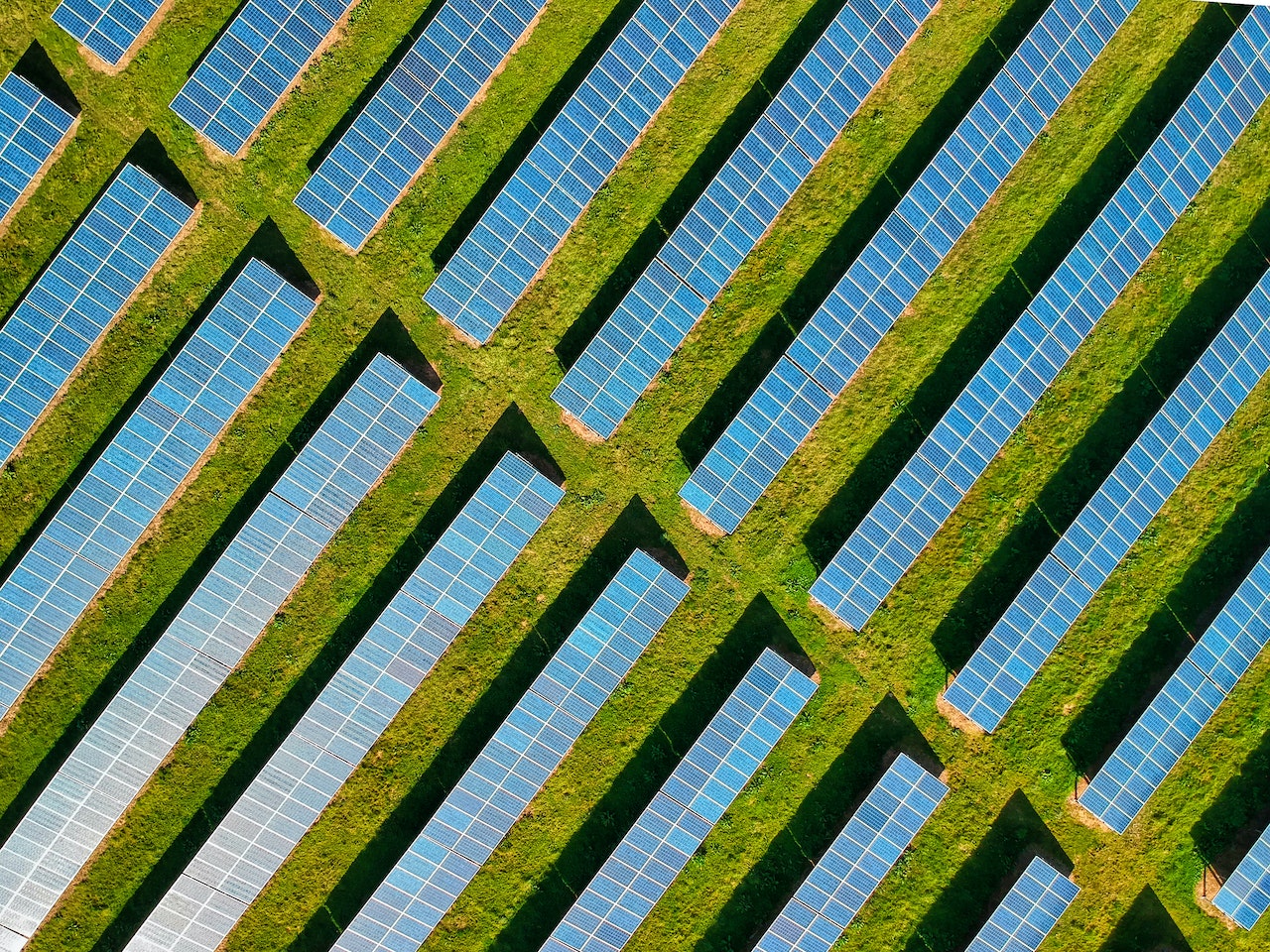

Photo by Red Zeppelin